Building a cryptocurrency portfolio is not something you do in 5 minutes. The rise of the cryptocurrency market and ICO’s, in general, has lured many investors into the idea of making big bucks as quickly as possible. And while there’s still plenty of opportunity out there, it pays (quite literally) to be as professional as you can.

It’s the wild wild west all over again, except this time, programmer cowboys are riding in on coded horses in search of digital gold. Arm yourself with some powerful tools so you too have a chance of striking it big.

Let’s dive in and take a look at 5 key points to consider when building a cryptocurrency portfolio.

#1: Bitcoin – The New Benchmark

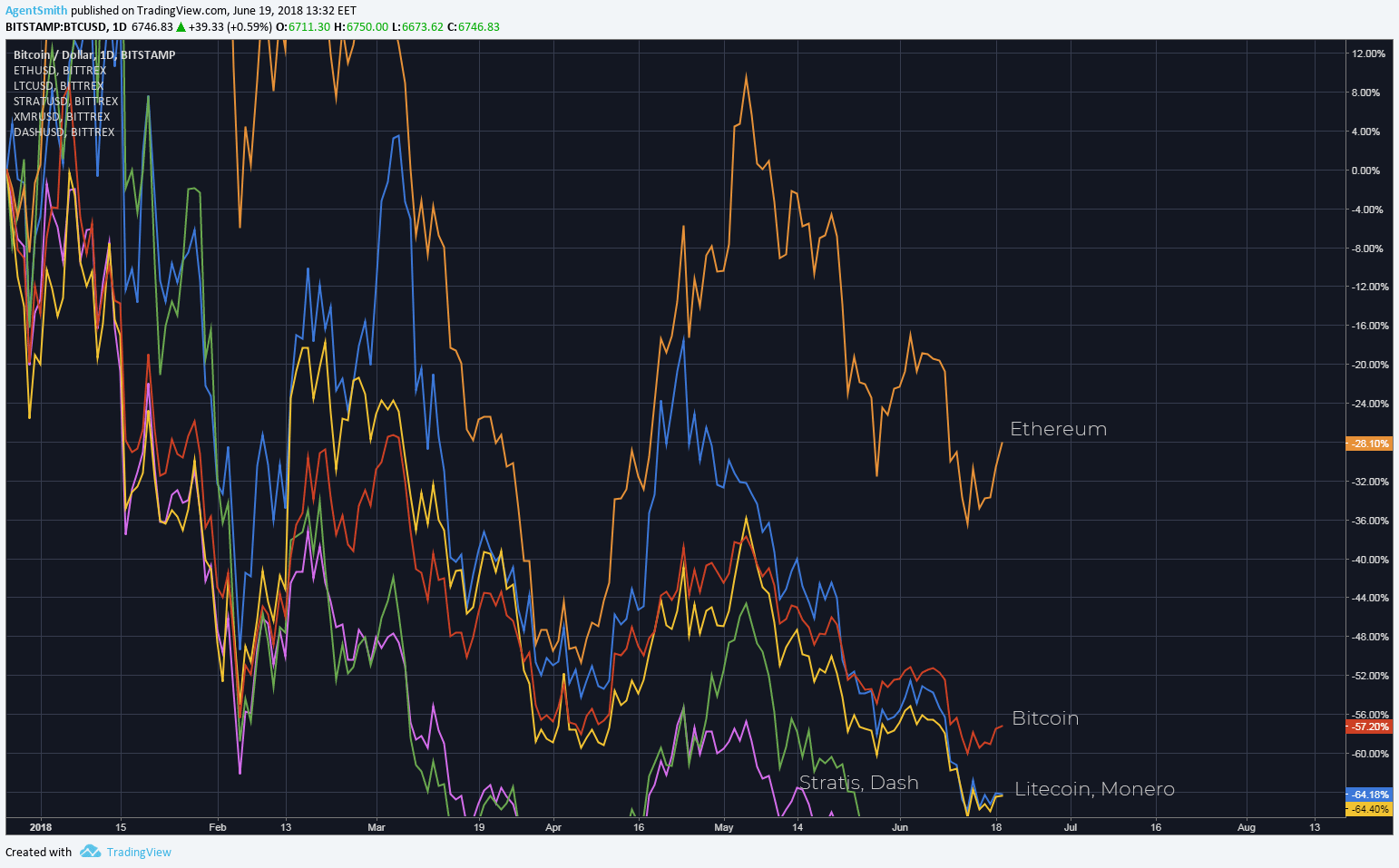

In the following graphic, we measure the % gains of several major cryptocurrencies against the US Dollar since the beginning of 2018:

Beginner investors love measuring the performance of their favorite coin versus their local currency (like the US Dollar or Euro). This is a mistake, however. Consider instead to measure your performance versus Bitcoin or Ethereum.

In the example above Bitcoin outperformed Litecoin, Monero, and Dash but not Ethereum. 2018 Has so far turned out to be a bear market and having more Ethereum in your portfolio would have minimized your losses. 28% Compared to Bitcoin’s 57%.

Why Benchmark?

The granddaddy of crypto didn’t achieve that title without good reason. Bitcoin’s enormous bull market since 2011 is the result of an economic value system which has been built with the properties of sound money in mind.

It’s no surprise then that many in the crypto community refer to Bitcoin as digital gold. Just as the physical kind is used as a store of value in troubled times so does capital flow into Bitcoin when investors become nervous:

- No hack of the Bitcoin blockchain has ever been recorded

- Bitcoin is widely available & well supported on exchanges around the world

- It is the most liquid cryptocurrency available (easy to find a buyer/seller in the market)

Many smaller coins underperform Bitcoin and are difficult to trade. Ask yourself, is it worth the risk to buy a lesser known coin? In many cases, just HODL’ing bitcoin and doing nothing for a few years will work out better in the long run.

#2: Understand Your Risk Profile

Risk is just as much a part of life as it is in the markets. No pain, no gain, as they say. Investing in this market means dealing with huge swings in price (volatility). And many do not have the stomach for it.

It is essential to ask yourself several questions related to cryptocurrency risk. It’s also a good idea to write down the answers. Some questions to consider:

- How much capital do you have to invest?

- Are you comfortable losing some or all of your capital?

- What are your investment goals?

- How close are you to retirement?

A good method to measure your risk tolerance is to see how well you sleep at night while invested in the cryptocurrency market. If you find yourself obsessing over price and getting up in the middle of the night to check, chances are, you have too much capital invested. Never ever invest money you cannot afford to lose!

You may want to consider hiring a financial advisor to do the work for you. But keep in mind that accredited financial advisors are almost unheard of in this emerging industry.

#3: Do Your Own Research (DYOR)

Perhaps the worst thing you can do in this market is to invest impulsively or based on a random tip you heard via friends, family, a Telegram channel or Reddit group. This is your money after all.

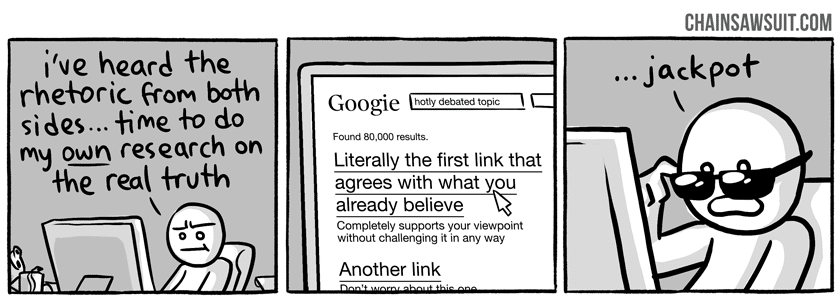

We live in the age of the internet, and information has never been so widely available as it is today. This is both a good and a bad thing. There’s a bunch of info out there. It’s relatively easy to find, but relatively hard to interpret. It’s your job, as an intelligent investor, to do your own due diligence.

Courtesy of Kris Straub

Every project is trying to market themselves in the best light possible. No project is perfect and many are just downright scams. Check in with the experts. There are some excellent sources on twitter providing valuable information on a daily basis.

#4: Take Full Responsibility for Your Decisions

Now that you’ve done the hard work, it’s time to actually add coins into your cryptocurrency portfolio and face the consequences. That’s right, you are completely responsible for all your investment decisions, both good and bad. Own it. It will make you a better investor.

Don’t be fooled by tweets, videos or posts by investors who claim they never lose. Even the best investors in the world make terrible decisions. It’s part of the game. When you accept your mistakes you also open the door to becoming a better cryptocurrency investor.

In no way, shape or form should any of this post be considered investment advice. If you’ve heard that before it’s because influencers all over the web fear providing content which could be considered as financial advice. Why? Because many investors who lose money often want to shift the blame to someone else. Don’t be that guy/girl.

The recent Bitconnect scandal, which saw a number of influencers served with lawsuits, is a good example. So I say it again, you are completely responsible for your own financial well-being.

#5: Be Patient

When people see double-digit returns in a major bull market it’s easy to catch a case of the fomo (fear of missing out). Be patient, play the long game. The market was here yesterday and it will be here tomorrow.

Unless you are a talented and active day trader, a longer-term HODL’ing strategy might be a better option for you. When you take the longer view, with practice and patience, it’s easier to stomach double-digit losses because you see the bigger picture. Bitcoin has already painted that picture since 2011.

Remember, there are no guarantees with this. Consider also the opposite side of the argument. Use patience as one tool in your larger toolkit. Being patient with a coin which goes to zero does not pay off. Either way, patience is a virtue worth building as you become a better investor.

Cryptocurrency Portfolio Summary

Cryptocurrency investment is not for everyone. Some will become stinking rich from it, and some will lose all their money. With some disciplined work, the chance of you becoming the former and not the latter increases dramatically.

To summarize, keep these 5 keys in mind when building your cryptocurrency portfolio and good luck out there in the markets!

- Bitcoin – The New Benchmark

- Understand Your Risk Profile

- Do Your Own Research (DYOR)

- Take Full Responsibility for Your Decisions

- Be Patient

This article by author Ryan Smith was originally posted on Coincentral. Republished with permission.